Our Products and Services

Invest with our Model

Our model allows us to bring the product closer to the client by eliminating costly layers of mark-ups that exist in the traditional model.

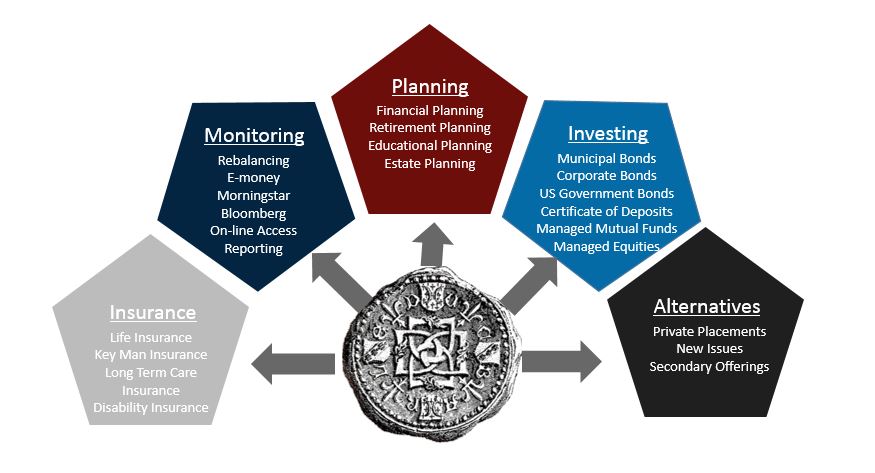

INSURANCE MONITORING PLANNING INVESTMENTS ALTERNATIVES

A successful portfolio requires detailed planning, risk management, and the right mix of investments. Our overarching strategy is to seek investment opportunities that we consider to be undervalued based on intense economic research, market valuation metrics, and spread analysis.

Portfolios may include investments across all asset classes and market capitalizations. Along with our two managed equity portfolio strategies, we utilize fixed income securities to meet client cash flow requirements while reducing volatility risk, and our core equity portfolios. Additionally, we may employ alternative strategies to augment portfolios.

Central to our approach is a rigorous research process that includes:

- A keen understanding of economic history which often repeats itself

- Internally developed security screeners and models

- Comparing valuation metrics and spread measures to their historic norms

- Tapping the knowledge base of our numerous industry experts and sell-side analysts

The experience and understanding of market mechanics to “buy when others are fearful and sell when others are greedy”

As a nimble, boutique firm, we have the ability to go after the inefficiencies in the market, which is where value often resides. As such, we do not participate in every area of the market at any given time, rolling maturities as they occur. Rather, we opportunistically seek out relative value within the market and focus our efforts on those areas until the opportunity subsides. In this manner, we employ a long-term, strategic approach to asset allocation, but also utilize tactical asset allocation to take advantage of short-term market inefficiencies along the way.